Imagine you’re in the grocery store and you overhear this conversation:

“I love my kids, but since they’ve both become really opinionated it feels like every family get together there’s some kind of fight. Sometimes I just want to disinherit them and give all our money to a peace-keeping charity to make a point.”

“I know how you feel. I’ve threatened to disinherit Suzie, but she just laughed and told me that the charity would probably be corrupt by the time I die and so it’ll all go to waste anyway. I’m thinking I’ll just give away most of my money now while I can still make sure it goes to places I like.”

“Oh, that’s an idea. But then, who’s going to make sure Roger is okay if I die first? I mean, I love the guy but he’ll be lost without me. Heaven knows he’ll need some kind of caregiver to help out and I know that’s expensive.”

“That seems simple. Just make sure all of your money goes to Roger if you die before he does. That way he can spend everything if he needs to.”

“That’s what I wanted to do, but then I read that if that tax laws change, it could mean that everything is taxed at something like 40% if there’s money left over when he dies. And I don’t want the government taking our money.”

“Oh. That feels like a catch-22.”

Do you have similar concerns? If you do, a disclaimer trust might be the way to go.

This blog post provides a high-level overview of what a disclaimer trust is, how it works, and a little insight into how you can put your own stamp on your trust.

What is a Disclaimer trust?

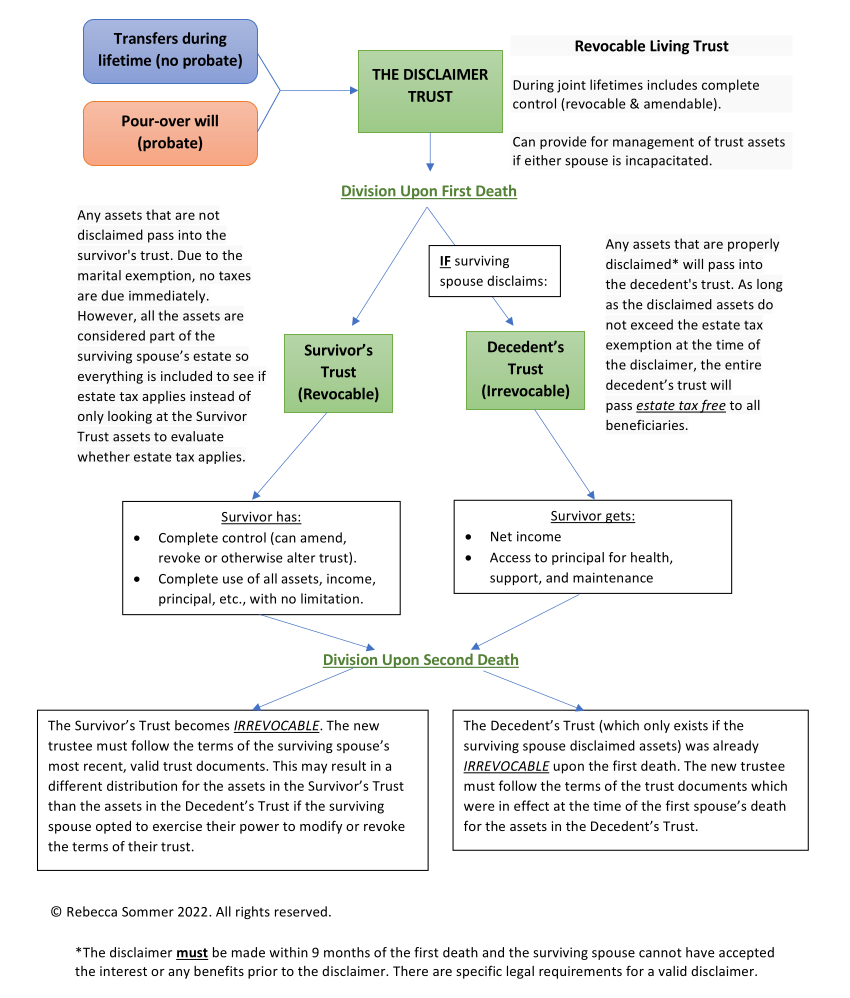

A disclaimer trust gives full control to the surviving spouse while providing for them to make a “qualified disclaimer” regarding any or all of their spouse’s assets at their spouse’s death. Assets that are properly disclaimed do not become part of the surviving spouse’s estate. Instead, they become part of an irrevocable trust, count against the deceased spouse’s estate tax exemption, and (provided the amount is under the exemption limit) pass estate-tax-free to beneficiaries.

At the same time, a disclaimer trust is flexible since it does not automatically put the assets into a irrevocable trust when the first spouse dies, but rather leaves that choice up to the surviving spouse at the time of the first spouse’s death. That means that the surviving spouse has the broadest possible control.

If a married couple wants to make sure the surviving spouse has maximum control over all aspects of the estate, but there’s a chance that for tax purposes they may want to remove assets from their estate (and in exchange give up complete control over the assets), then a disclaimer trust may be a good fit. Like all revocable living trusts there are additional benefits such as distribution according to your terms while avoiding the headaches of probate (assuming your trust is properly funded).

However, disclaimer trusts have some risks. First, if your estate exceeds the estate tax exemption at the time of death and the surviving spouse fails to properly and timely disclaim assets, the federal estate tax of up to 40% will be levied on the amount in excess of the exemption. While you may feel confident now that the surviving spouse will be able to take timely action to property disclaim, you need to keep in mind that the surviving spouse will be grieving and may have an illness or mental challenges by the time the first spouse dies. If they do, they may miss making the disclaimer on time (or may do it improperly) and the end result could be a big tax bill faced by your beneficiaries after you both die.

Second, the surviving spouse can change all of the terms of the trust for any assets they don’t disclaim. So if you are the first to die and your spouse remarries, or suddenly becomes enamored with a charity, or has a falling out with one (or more) of your beneficiaries, the assets you left behind may go to people you did not intend to receive anything. This could be a benefit if you want your spouse to be able to change anything they want after you die, but for others it could be a downside. You need to carefully evaluate your own preferences to determine if this is a pro or con for you.

How it works

Once the disclaimer trust is set up, you will transfer assets into the trust. Some assets may also pass by beneficiary designation. You should consult your lawyer and your tax professional regarding which method makes the most sense for your assets.

When the first spouse dies, the surviving spouse has 9 months to disclaim assets so they pass into the Decedent’s Trust and will not be considered part of the surviving spouse’s estate. Keep in mind that the surviving spouse cannot have accepted the interest or any benefits of an asset in order to disclaim it properly. The safest option is to call your legal and tax professionals before accessing any accounts or accepting proceeds for any policies to evaluate your options.

If the surviving spouse does not disclaim any assets, then upon the surviving spouse’s death, all of the assets are part of that spouse’s estate and will be distributed according to the terms of the most recent valid trust documents executed by that spouse.

Or, if the surviving spouse does disclaim assets but does not modify any terms of their trust, then the trustee will be bound by the terms of the trust document that both spouses executed.

Finally, if the surviving spouse disclaims assets and also modifies the terms of the Survivor’s Trust, then the trustee will need to look at two trust documents – the operative trust for the Decedent’s Trust as well as the operative trust for the Survivor’s Trust.

This infographic outlines the general process and highlights some of the key characteristics of a disclaimer trust:

What About Specific Terms?

As with most trusts, you can customize a disclaimer trust to meet your specific needs and wishes. It is not possible to cover everything in this post, but as an example you can have your disclaimer trust create specialty trusts at the time of the second spouses death. For example, you can have language to set up a pet trust to take care of your furry friends once you are both gone.

You can also customize what your trustee(s) can or cannot do, give specific requirements for beneficiaries to be able to claim their inheritance, or give specific directions (for tax purposes or otherwise) for your trustee(s) and/or beneficiaries to follow.

Here are some options you could consider:

- Set up a timeframe by which someone has to survive you in order to get the inheritance. Why? Well, if someone you are giving money to dies a month after you do, they probably haven’t been able to use any of the money yet because it likely has not been distributed since all expenses, such as funeral costs, need to be dealt with first. In that case, if you have not set up language having them survive you by more than a month, then their inheritance will go directly into their estate. In that case, their heirs get the money and you may have wished to have given the money to a different beneficiary if you had known that was going to happen.

- Give a specific person (or person(s)) the ability to buy your house from the trust for a specific percentage of the fair market value of the property. This can be particularly beneficial if you have a child who you would like to help subsidize their ability to be a home-owner by giving them easier access (or a lower price-point) but you do not want to give the property outright.

- Ensure that beneficiaries are not entitled to their inheritance until they reach a specific age so that it does not get counted against them on college applications. Or simply because you want to make sure they are old enough that the funds are likely to be used wisely.

There are many more customizations to consider, but hopefully these examples give you some ideas of what you can do to make your trust work best for you.

Do You Have More Questions?

For expert help in putting together your estate plan, or to simply get some additional information, contact us for a free consultation.

Call For A Free Assessment

Of Your Needs - (657) 571-1241