Overview Of Probate Avoidance Trust

If you are single, if you are married but have very limited assets (and do not mind the surviving spouse making any changes they want after your death), or if all of your estate is going to charity, you may want to consider a probate avoidance trust. This type of trust is not designed to use tax minimization strategies. Instead it simplifies the process for the trustee. It also provides benefits that are common to revocable living trusts, such as distribution according to your terms while avoiding the headaches of probate (assuming your trust is properly funded).

How It Works

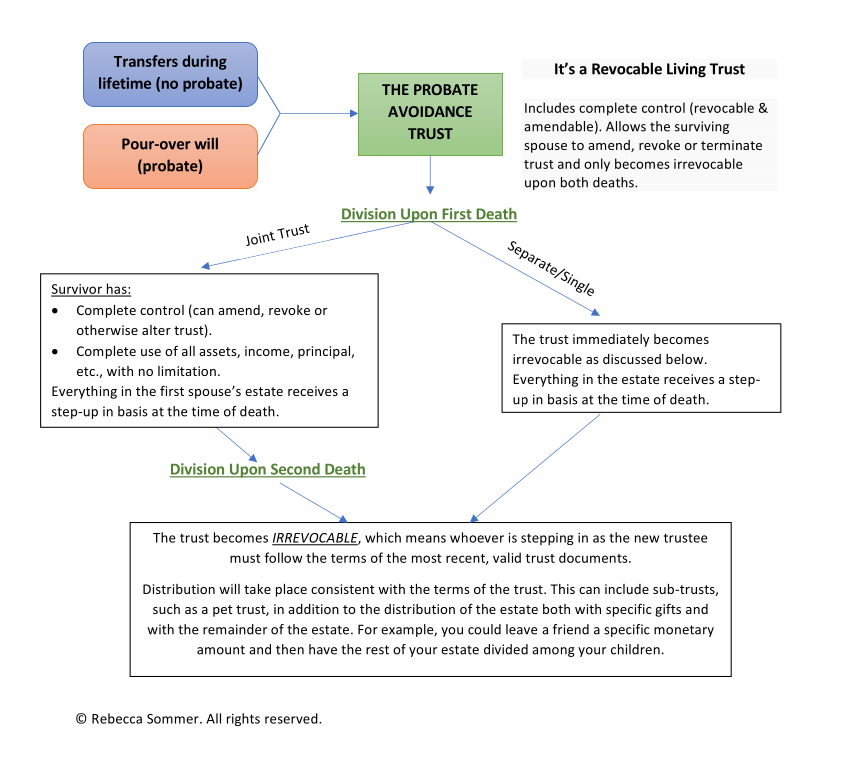

If your probate avoidance trust is for just you (either as a single person or as a married person with a separate trust from your spouse), at the time of your death the trust becomes irrevocable and your estate will pass outside of probate consistent with your chosen distribution terms and process.

If your probate avoidance trust is a joint trust for you and your partner, the trust continues to be fully revocable until the survivor dies.

This infographic outlines some of the key characteristics of the probate avoidance trust:

What About Specific Terms?

As with all estate planning tools, you are in control over the terms you would like to govern the trust. The structure of the trust dictates broad terms such as how the estate is treated for tax purposes and the power you (or your spouse) have to revise the terms and use of the assets. However, there are many additional terms and conditions that are completely customizable to suit your needs. If you work with a lawyer, you should be able to do a great deal of customization as well as get expert feedback on the pros and cons of different approaches. If you are using an online form or package, your ability to customize terms and conditions may be very limited.

“…while probate avoidance trusts are simple in concept, they are still a very powerful tool that can be highly customized…”

It is not feasible to cover all possibilities in this post. However, some potential customizations include:

- Trustee Powers: Based on your preferences and comfort level, you choose how much power to give your successor trustee (i.e. the person who will manage your assets after you). For example, you can give them the ability to give monetary gifts out of your estate to beneficiaries during your lifetime, which could be a tax benefit if your estate is getting close to exceeding the federal exemption.

- Incapacity: You can decide how you want your incapacity to be determined, such as only by a court, or by doctor notes, etc. Then you can outline what your successor trustee’s obligations to you while you are alive but incapacitated as well as their powers to carry out those obligations. This gives you the benefit of having someone who can immediately step in to manage your trust assets without having to go to court. Combined with a power of attorney, it is a powerful tool to ensure you can be well taken care of when you need help the most.

- Bequest Terms and Conditions: Depending on your circumstances, you may want to control distribution to your beneficiaries based on age, graduation from college, or other factors. You can also give one or more of your beneficiaries the option to purchase a specific property for a specific price (most commonly at 93% of fair market value), forgive a debt, gift specific item(s), or even give a lifetime interest which then passes to another beneficiary after the first beneficiary dies.

In sum, while probate avoidance trusts are simple in concept, they are still a very powerful tool that can be highly customized to suit your specific situation and take advantage of the benefits of a revocable living trust.

Wondering If A Probate Avoidance Trust Is Right For You?

For expert guidance, contact us for a free consultation.

Call For A Free Assessment

Of Your Needs - (657) 571-1241